INTERNAL AUDIT UNIT (IA)

The main task of the Bank CIMB Niaga Internal Audit Unit (IA) is to ensure that the Bank’s management and operational processes are in compliance with applicable rules and regulations while also supporting the Bank’s interests and objectives. IA is also responsible for ensuring that the adequacy and internal control processes are functioning properly. IA helps the Bank achieve its objectives by assessing and improving the effectiveness of governance, internal control processes, and risk management. IA CIMB Niaga also provides independent and objective assurance, consulting, and advisory services that can add value to the Bank’s operations.

INTERNAL AUDIT CHARTER

In carrying out its duties and responsibilities, IA is guided by the Internal Audit Charter, which contains the main principles of IA’s professional practices, vision and mission, objectives, structure and position, authorities, duties and responsibilities, function and scope of assignment, independence and objectivity, professionalism, impartiality, rights and obligations of the Head of IA (Chief Audit Executive), as well as the IA code of ethics. The Internal Audit Charter was last updated on 26 June 2023, and was approved by the President Director and Board of Commissioners.

The Internal Audit Charter is a form of compliance with OJK Regulations and OJK Circular Letters, related to the Implementation of the Internal Audit Function in Commercial Banks, the Establishment and Guidelines for Preparing Internal Audit Charters, Financial Conglomerates, Implementation of Information Technology by Commercial Banks, Implementation of Risk Management for Commercial Banks, Standard Guidelines for Internal Control Systems for Commercial Banks, Confidentiality and Security of Consumer Data and/or Personal Information; as well as best practices in referrence to the IPPF (International Professional Practice Framework) standards from IIA (The Institute of International Auditors).

The Internal Audit Charter regulates the implementation of audits and guidelines to ensure:

- Effectiveness, efficiency and adequacy of internal control system, risk management and sustainable governance.

- Reliability, effectiveness, and integrity of information management processes and systems, including relevance, accuracy, completeness, availability, and confidentiality of data.

- Compliance with applicable laws and regulations.

- Quality of the organization’s performance.

- Interaction with various governance groups has been running as it should.

- Important financial, managerial, and operational information must be accurate, reliable, and timely.

- Resources are obtained economically, utilized efficiently, and protected adequately.

- Programs, plans, and targets are achieved well.

- Quality and continuous improvement are inherent in CIMB Niaga’s control processes.

- Opportunities to improve CIMB Niaga’s management controls, profitability, and reputation are identified and disclosed in the audit.

PARTY WHO APPOINTS AND DISMISSES HEAD OF IA (CHIEF AUDIT EXECUTIVE)

IA is chaired by the Chief Audit Executive, who is appointed and dismissed by the President Director with the approval of the Board of Commissioners and based on the recommendation from the Audit Committee. Currently, the Chief Audit Executive is Antonius Gunadi, who has been in office effectively since 3 January 2017, based on Decree No. 024/HROB/HRS/XII/2016. The appointment was reported to OJK in letter No. 008/DIR/ XII/2016 dated 19 December 2016.

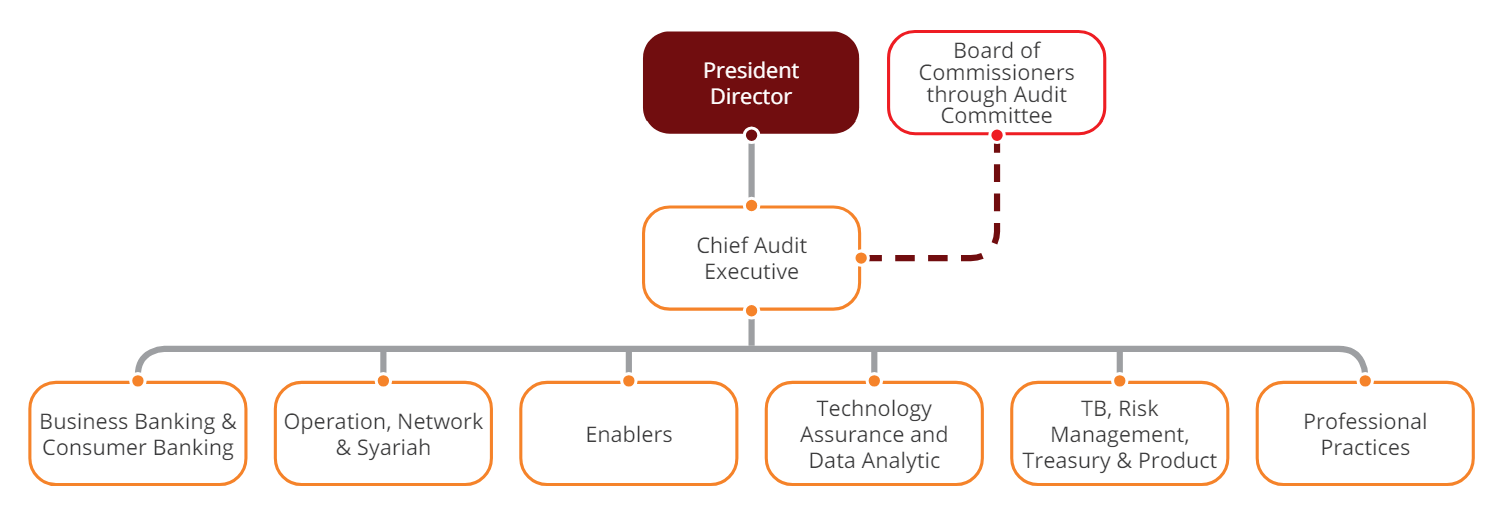

STRUCTURE AND POSITION OF IA IN THE ORGANIZATION

In line with POJK No. 1/POJK.03/2019 dated 28 January 2019 concerning Implementation of the Internal Audit Function in Commercial Banks and POJK No. 56/ POJK.04/2015 dated 29 December 2015 concerning Establishment and Guidelines to Prepare the Internal Audit Charter, IA is directly responsible to the President Director and, in the matrix, to the Board of Commissioners through the Audit Committee.

PROFILE OF HEAD OF IA (CHIEF AUDIT EXECUTIVE)

Antonius Pramana Gunadi

Chief Audit Executive

Age/Gender |

: | 49/Male |

Nationality |

: | Indonesia |

Domicile |

: | Jakarta |

Legal Basis of Appointment |

: | 024/HROB/HRS/XII/2016 |

Education |

: |

|

Work Experiences |

: |

|

Certifications |

: |

|

Organization Membership |

: |

|

Award |

: |

|

EDUCATION AND/OR TRAINING OF INTERNAL AUDIT UNIT

| Training / Workshop / Conference / Seminar | Organizing Institute | Time and Location |

|---|---|---|

| CIMB Sustainability Academy : CISL - Module 1 | CIMB-CISL | 11 January 2023 Online |

| CIMB Sustainability Academy : CISL - Module 2 | CIMB-CISL | 12 January 2023 Online |

| Digital Sharing Session : Cyber Security Outlook 2023 & Handling Cybersecurity Incidents in the Financial Service Sector | Amazon Web Services (AWS) & Badan Siber dan Sandi Negara (BSSN) | 16 January 2023 Graha CIMB Niaga Jakarta |

| CIMB Sustainability Academy : CISL - Module 5 | CIMB-CISL | 23 February 2023 Online |

| CIMB - CISL Module 8 | CIMB | 5 March 2023 Online |

| Advanced Media Handling Skills | CIMB Niaga - Maverick PR Agency & Consultant | 10 March 2023 Graha CIMB Niaga Jakarta |

| CIMB Sustainability Academy : CISL - Module 6 | CIMB-CISL | 14 March 2023 Online |

| Digital Sharing Session - Cyber Security Outlook 2023 | CIMB Niaga | 31 March 2023 Graha CIMB Niaga Jakarta |

| CIMB Leading Leaders Development Programme - Gearing up for the Future - Leadership Impact | IMD | 25-9 June 2023 Lausannem, Swiss |

| Lunch and Learn: Future of Self-service AI and Analytics | CIMB Niaga | 20 June 2023 Graha CIMB Niaga Jakarta |

| Digital Strategy Workshop with BCG | CIMB Niaga | 10 September 2023 Langham - Jakarta |

| CIMB Leading Leaders Development Programme - Orchestrating Winning Performance Singapore | IMD | 20-24 November 2023 Singapura |

DUTIES AND RESPONSIBILITIES OF IA

As stated in the Internal Audit Charter, IA has the following duties and responsibilities:

- Assisting the President Director and Board of Commissioners in supervision by operationally defining the planning, implementation, or monitoring of audit results.

- Analyzing and assessing finance, accounting, operations, and other activities through audit.

- Identifying all opportunities to improve and increase efficient use of resources and funds.

- Providing suggestions for improvements and objective information about the activities examined in all management activities.

- Preparing and implementing an annual audit plan based on a comprehensive risk assessment-based methodology. The annual audit plan and budget allocation are approved by the President Director and the Board of Commissioners by taking into account recommendations from the Audit Committee.

- Executing audit activities and providing assessments on the efficiency and effectiveness in finance, accounting, operations, human resources, marketing, information technology, and other activities.

- Periodically reporting to the Board of Directors and Board of Commissioners through the Audit Committee regarding the objectives, authority, and responsibilities, as well as the performance of IA activities compared to the plans. Reporting also includes exposing significant risks and control issues.

- Preparing semester reports on the Implementation Report and Internal Audit Results to OJK for a summary of audit activities and significant audit findings, no later than 1 month after the end of the period.

- Monitoring the implementation of follow-up on audit findings and recommendations. All significant audit findings will remain in “open” status until the findings are resolved. This includes informing the Audit Committee regarding Management Acceptance of Risk (if any).

- Informing the status of corrective actions regarding audit findings and audit recommendations to the Board of Directors and Board of Commissioners through the Audit Committee.

- Informing the Anti-Fraud Management unit about indications of fraud discovered by the audit team.

- Preparing measurements to assess the success of performance and achievement of IA goals.

- Preparing and storing adequate audit working papers in accordance with applicable regulations.

- Implementing and delivering Quality Assurance and Improvement Programs (QAIP) which covers all aspects of IA activities. The QAIP includes evaluating IA compliance with the definition of Internal Audit and Standards, as well as evaluating whether the auditor implements the code of ethics. QAIP also assesses the efficiency and effectiveness of IA activities and identifies opportunities for improvement.

- Reporting specifically to OJK regarding IA’s findings that may significantly disrupt CIMB Niaga’s business continuity. Reports must be submitted no later than 3 (three) days after discovery.

- Reporting to OJK regarding the results of external review containing opinions on IA’s work result and compliance with PPFAIB, as well as improvements that can be made.

- In terms of implementing the Integrated Governance

and with CIMB Niaga’s role as the Main Entity that

already has an established IA, the implementation

of Integrated IA tasks is carried out by the existing IA

with the following responsibilities:

- Auditing at Financial Services Institutions (FSI) either individually, joint audits, or based on reports from IA FSI.

- Monitoring and evaluating the implementation of Integrated IA in each member of the CIMB Indonesia Financial Conglomeration, coordinating with all IA members of the CIMB Indonesia Financial Conglomeration according to their functions, and compiling the results of the implementation of Integrated IA from each member of the CIMB Indonesia Financial Conglomeration, periodically (every semester).

- Preparing and submitting reports on the implementation of the duties and responsibilities of Integrated IA to the Director appointed to supervise FSI in the Financial Conglomeration, Director of Compliance of Main Entity and Board of Commissioners of Main Entity.

INTERNAL AUDITOR CODE OF ETHICS

The Chief Audit Executive and all IA employees are required to follow the CIMB Niaga Code of Ethics and Code of Conduct, as well as the CIMB Niaga Internal Auditor Code of Ethics, which is based on and refers to the Institute of Internal Auditors’ Code of Ethics. Every year, all IA members receive a refresher on the Code of Ethics and sign a statement about it. The CIMB Niaga Internal Auditors Code of Ethics is as follows:

- Integrity

The integrity of the Internal Auditors builds a sense of trust and thereby provides a basis for confidence in the assessment they provide. - Objectivity

Internal Auditors maintain the confidentiality of information received and are not authorized to disclose it without clear authority, except in accordance with the Bank’s policy regarding provision of information/data/documents to external parties. - Confidentiality

Internal auditors must demonstrate high professional objectivity in collecting, evaluating, and communicating information regarding the activity or process being audited. Internal auditors carry out a balanced assessment of all existing relevant facts without being influenced by their own or other people’s interests. - Competency

Internal Auditors apply the knowledge, skills, and experience needed to provide IA services.