CIMB Niaga has appointed Fransiska Oei as Corporate Secretary under CIMB Niaga Board of Directors' Circular Resolution No.001/SIR/DIR/IX/2016 dated 21 September 2016, in accordance with OJK Regulation No. 35/POJK.04/2014 dated 8 December 2014. The appointment was reported to the OJK on 23 September 2016 and announced to the public via the OJK Electronic Reporting Facility (Sarana Pelaporan Elektronik/SPE) system or IDXNet on the same date.

Fransiska Oei

Corporate Secretary

TERM OF OFFICE & DOMICILE

Fransiska Oei has served as Corporate Secretary effective since 26 September 2016 until the present. She is domiciled in Jakarta, Indonesia.

LEGAL BASIS

CIMB Niaga has appointed Fransiska Oei as Corporate Secretary under CIMB Niaga Board of Directors’ Circular Resolution No.001/SIR/DIR/IX/2016 dated 21 September 2016, in accordance with POJK No. 35/POJK.04/2014 dated 8 December 2014. The appointment was reported to the OJK on 23 September 2016 and announced to the public via the OJK Electronic Reporting Facility system, or IDXNet, on the same date.

The full profile is presented in the Board of Directors’ Profiles in the Profile of Board of Directors.

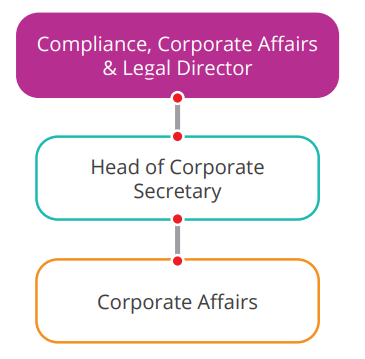

ORGANIZATIONAL STRUCTURE OF CORPORATE SECRETARY

DUTIES AND RESPONSIBILITIES

CIMB Niaga Corporate Secretary’s duties and responsibilities include the following:

-

Keep abreast of developments in the capital market in particular, as well as applicable and prevailing laws and regulations in the Capital Market.

-

Provide input to the Board of Commissioners and Board of Directors to comply with laws and regulations in the Capital Market.

-

Assist the Board of Commissioners and Board of Directors in implementing Good Corporate Governance, which includes:

- Public disclosure of information, including its availability on the Bank's website;

- Timely submission of reports to the Regulator;

- Implementation and documentation of the GMS;

- Implementation and documentation of meetings of the Board of Commissioners and/or Board of Directors, including the preparation of meeting minutes; and

- Organizing the bank-wide orientation program for new members of the Board of Commissioners and Board of Directors.

-

Coordinate with the Investor Relations unit to ensure Annual Public Expose as well as other required Public Exposes, including Analyst Meeting are regularly held.

-

Ensure the delivery of information to shareholder is equally implemented for every shareholder of the Bank.

-

Responsible for the implementation of the Bank's Corporate Actions in coordination with the Finance unit and/or other appointed units as well as with Capital Market supporting institutions.

-

As a liaison between the Bank and its shareholders, regulators, and other stakeholders.

-

The Corporate Secretary and employees in their work units are obliged to maintain the confidentiality of confidential documents, data, and information, except when required to fulfill obligations under applicable laws and regulations or as otherwise specified in applicable laws and regulations.

-

The Corporate Secretary and employees in their work units are prohibited to take any personal advantage, directly or indirectly, that would be detrimental to the Bank.

-

The Corporate Secretary and employees in their work units shall improve their knowledge by pursuing education and/or training that will support the implementation of their duties and responsibilities.

-

Prepare and maintain a list of shareholders with ownership of 5% (five percent) or more of the Company's shares, as well as a list of the 20 (twenty) largest shareholders, and upload the said information on the Bank's website.

-

Provide a special list containing information regarding the shares of members of the Board of Commissioners and Board of Directors and their families in the Bank, its affiliates, and/or other companies, including, among other things, share ownership, business relationships, and other roles that lead to a conflict of interest with the Bank, and upload such information to the Bank's website.

-

Timely submissions of reports related to provisions in the Capital Market, both periodic and incidental reports to the regulators.

-

Conduct disclosure of information to the public in accordance with applicable laws and regulations.

-

Improve and align the Bank's Governance implementation with the OJK and ASEAN Corporate Governance Scorecard principles.